Exploring the Best Data Center Real Estate Investment Trusts (REITs) for a Secure Investment Opportunity

Digital Realty Trust Inc. (NYSE: DLR), American Tower Corp. (NYSE: AMT), Equinix Inc. (NASDAQ: EQIX), and Iron Mountain Inc. (NYSE: IRM) stand out as leading data center Real Estate Investment Trusts (REITs). These REITs, accessible on trading platforms such as Webull, eToro, and Robinhood, offer a unique investment opportunity in a high-growth sector. The surge in demand for data storage, driven by businesses transitioning to multi-cloud networks and the need for 5G network support, has positioned data center REITs as an attractive investment.

Real estate investment trusts (REITs) diversify investment portfolios by pooling funds to invest in real, tangible real estate assets. Data storage, as an industry, faces exponential growth, expected to see an increase of $615.96 billion from 2022 to 2026. Data center REITs play a crucial role in securing data, a need magnified by more frequent cyberattacks and the move towards cloud computing.

What Are REITs?

REITs enable investors to allocate funds to real estate without the complexities of direct property ownership. These funds can act as an inflation hedge, as property values and rents often rise with inflation. With yields generally around 5%, REITs present an enticing option for investors looking for higher returns compared to traditional stocks and bonds. Some REITs even offer yields exceeding 10%.

Understanding Data Center REITs

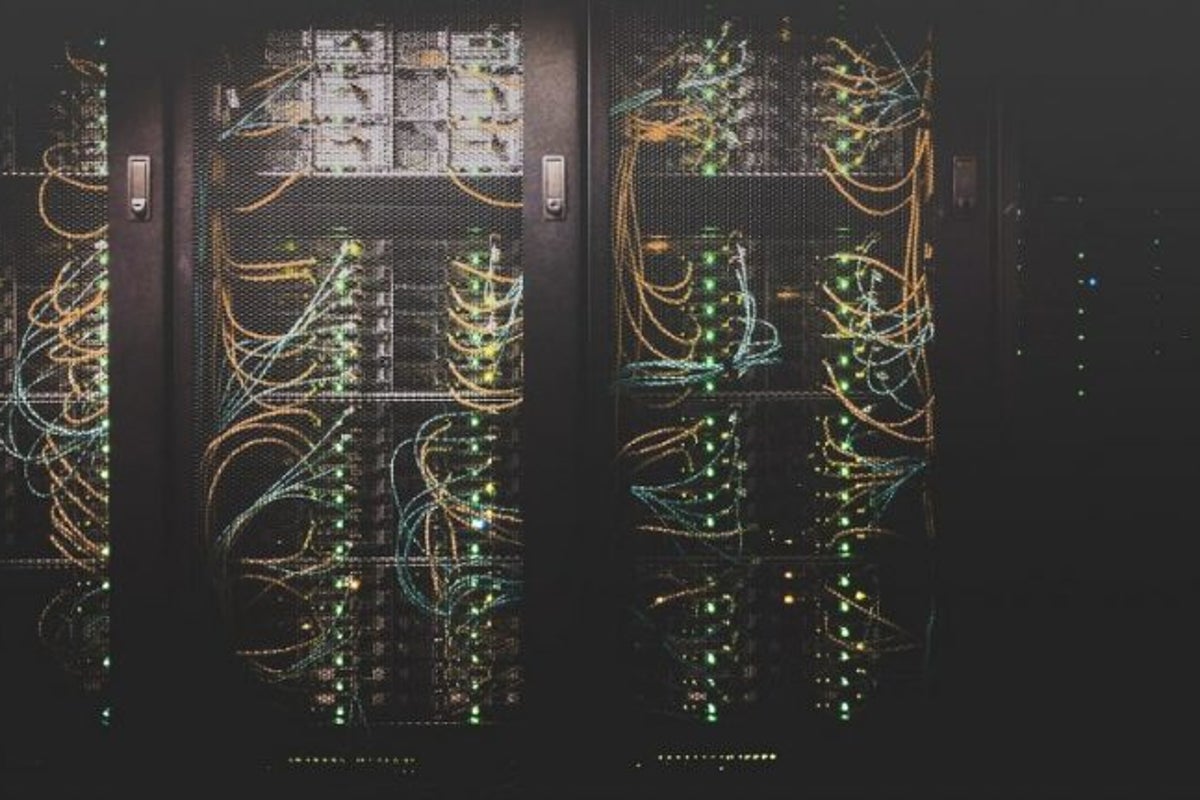

Data center REITs specialize in housing the critical infrastructure required for data storage, including servers, networks, and other support equipment. These REITs lease land for data center construction, providing a vital service to companies that require secure and reliable data storage solutions. The shift towards cloud-based storage, despite the rising risks of cyberattacks, further emphasizes the value of physical data centers, especially for sectors with stringent data compliance requirements like government agencies.

What are the Advantages of Data Center REITs?

Data center REITs offer several advantages, including recession resistance, tech exposure with lower risk, and the potential for steady, above-average yields. These REITs have proven resilient, maintaining demand across economic fluctuations due to the essential nature of data storage. Moreover, they provide an entry point into the technology sector without the volatility associated with tech startups, and the long-term contracts common in the industry ensure a consistent revenue stream.

Best Data Center REITs

The best data center REITs to consider for your investment portfolio include Digital Realty Trust, American Tower Corp, Equinix, and Iron Mountain. These REITs have demonstrated a strong track record of performance, financial stability, and consistent returns to investors. Notably, each offers a unique proposition in terms of yield, growth potential, and financial health, making them suitable for different investment strategies.

Digital Realty Trust (DLR)

With an extensive portfolio of over 300 data centers globally, Digital Realty Trust provides scalable solutions ranging from individual cabinets to large-scale buildings. This REIT boasts a balanced financial profile with a solid dividend history and a sustainable payout ratio, appealing to investors looking for stable returns.

American Tower Corp (AMT)

American Tower Corp, initially focused on cell phone towers, expanded into data centers through the acquisition of CoreSite Realty Corporation. Despite its higher debt level, the growth potential and attractive yield make AMT a promising option for investors willing to accept moderate risk.

Equinix (EQIX)

Equinix stands as one of the largest global data center managers, serving a diverse client base. Its low yield is compensated by long-term contracts and a strong financial standing, offering a lower-risk tech investment opportunity.

Iron Mountain (IRM)

Originally specializing in physical record storage, Iron Mountain has successfully transitioned into digital data storage, providing a solid yield and a strong return on equity. Its diversified services and high customer retention rate underscore its investment appeal.

How to Buy the Best Data Center REITs

Investors can conveniently purchase top data center REITs through online trading platforms such as Webull, eToro, and Robinhood. These platforms enable easy, commission-free trading, making it more accessible for individuals to include REITs in their investment portfolios.

How to Buy the Best Data Center REITs With an IRA

Holding REITs in an IRA or Roth IRA can provide tax advantages, maximizing the potential return on these investments. Brokerage firms like TD Ameritrade and Fidelity offer platforms for purchasing REITs within IRA accounts, alongside educational resources to assist investors in making informed decisions.

How to Trade or Sell Your Data Center REIT

Trading data center REITs is straightforward and cost-effective, thanks to the advent of online brokers that offer commission-free trades. The flexibility of fractional investing further lowers the entry barrier, allowing investors to allocate funds according to their budget.

Are Data Center REITs a Good Investment?

In an era where the tech industry faces challenges, data center REITs offer a secure haven. The undiminished demand for data storage, coupled with the resilience and steady income potential of these REITs, makes them an attractive investment. For those looking to diversify into tech with lower risk and consistent yields, data center REITs are a compelling option.